Retirement Planning

Simply put, our utmost priority is to help you achieve a safe, happy, and secure retirement.

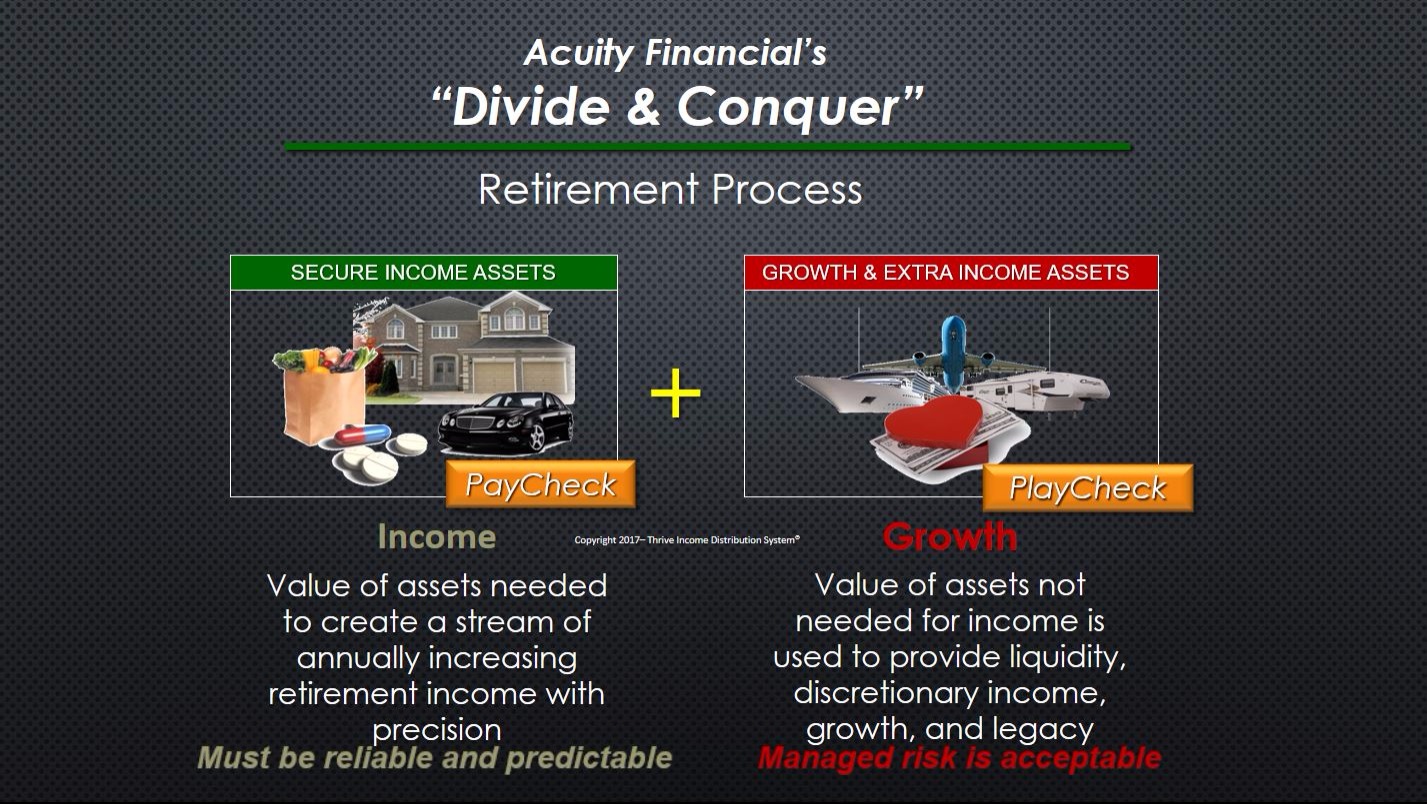

We take a “Divide and Conquer” approach to retirement planning. First, we gather information on your assets, retirement goals, and anticipated monthly retirement expenses. Using your expenses as a base point, we will formulate an income plan designed to maintain your standard of living over time, so you do not have to worry about running out of money. We will help you maximize your Social Security benefits. By including potential rising taxes and inflation in the equation, our goal is to give you the MOST value using the LEAST amount of your portfolio.

Next, using the assets that are not needed to cover basic expenses, we turn our attention to the rest of your portfolio. Here, we'll focus on determining the proper levels of liquidity, satisfying estate and legacy goals, managing other retirement risks, and investing with the goal of maximizing growth. Using this Divide and Conquer strategy, we strive to create an easy-to-understand retirement planning experience that will help give you confidence through all stages of your life.